What is support and resistance?

Support and resistance levels are horizontal price levels that typically connect price bar highs to other price bar highs or lows to lows, forming horizontal levels on a price chart.

A support or resistance level is formed when a market’s price action reverses and changes direction, leaving behind a peak or trough (swing point) in the market. Support and resistance levels can carve out trading ranges like we see in the chart below and they also can be seen in trending markets as a market retraces and leaves behind swing points.

Price will often respect these support and resistance levels, in other words, they tend to contain price movement, until of course price breaks through them.

In the chart below, we see an example of support and resistance levels containing price within a trading range. A trading range is simply an area of price contained between parallel support and resistance levels like we see below (price oscillates between the support and resistance levels in a trading range).

Note that in the chart below, price eventually broke up and out of the trading range, moving above the resistance level, then when it came back down and tested the old resistance level, it then held price and acted as support…

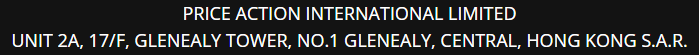

The other primary way support and resistance levels are created in a market, is from swing points in a trend.

As a market trends, it retraces back on the trend and this retracement leaves a ‘swing point’ in the market, which in an uptrend looks like a peak and a downtrend looks like a trough.

In an uptrend, the old peaks will tend to act as support after price breaks up past them and then retraces back down to test them. In a downtrend, the opposite is true; the old troughs will tend to act as resistance after price breaks down through them and then retraces back up to test them.

Here’s an example of a market testing previous swing points (support) in a downtrend, note that as the market comes back to test the old support, the level then behaves as ‘new’ resistance and will very often hold price. It’s wise to look for an entry point into a trend as it comes back and tests these previous swing points (see pin bar sell signal in chart below), because it’s at these levels that the trend is most likely to resume, creating a low-risk / high-reward potential:

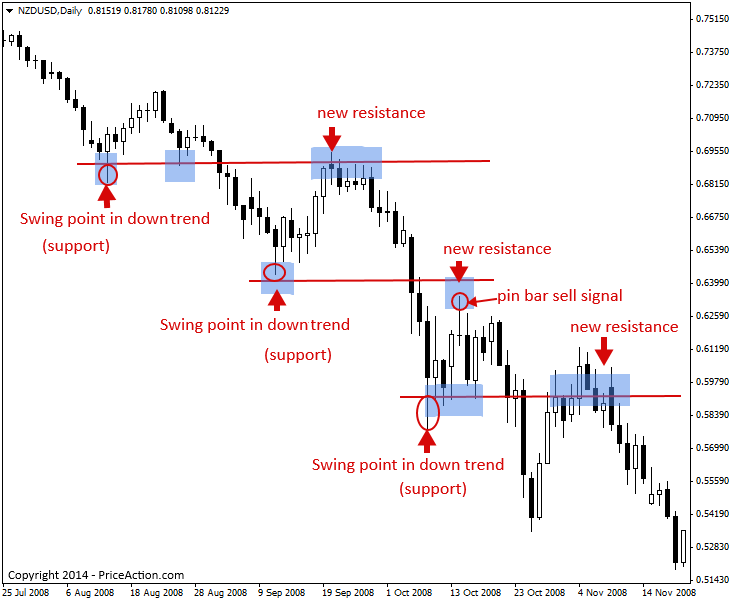

How to trade price action signals from support and resistance levels

Support and resistance levels are a price action trader’s ‘best friend’. When a price action entry signal forms at a key level of support or resistance, it can be a high-probability entry scenario. The key level gives you a ‘barrier’ to place your stop loss beyond and since it has a strong chance of being a turning point in the market, there’s usually a good risk reward ratio formed at key levels of support and resistance in a market.

The price action entry signal, such as a pin bar signal or other, provides us with some ‘confirmation’ that price may indeed move away from the key level of support or resistance.

In the example chart below, we see a key level of resistance and a bearish fakey strategy that formed at it. Since this fakey showed such aggressive reversal and a false-break of the key resistance, there was a high-probability that price would continue lower following the signal…

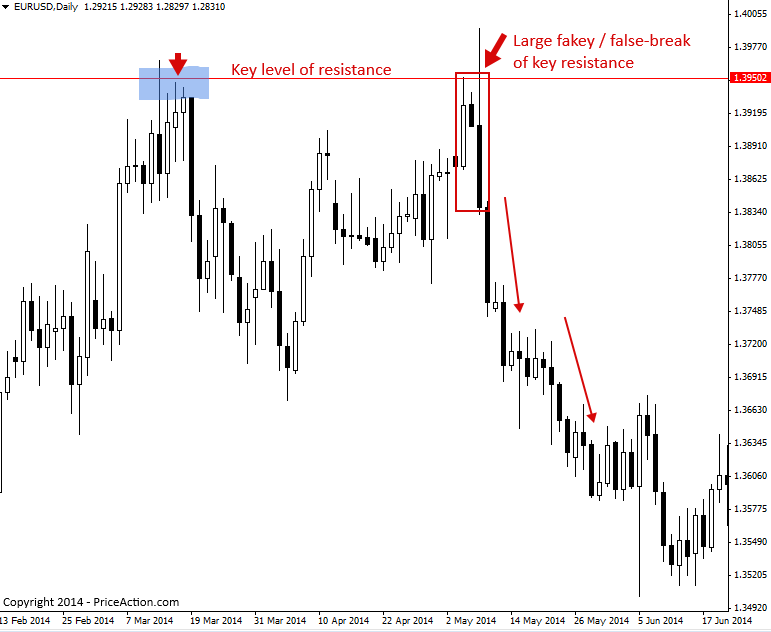

The next example chart shows us how to trade price action from a support level in an uptrend. Note that once we got a clear pin bar buy signal, actually two pin bar signals in this case, the uptrend was ready to resume and pushed significantly higher from the key support level.

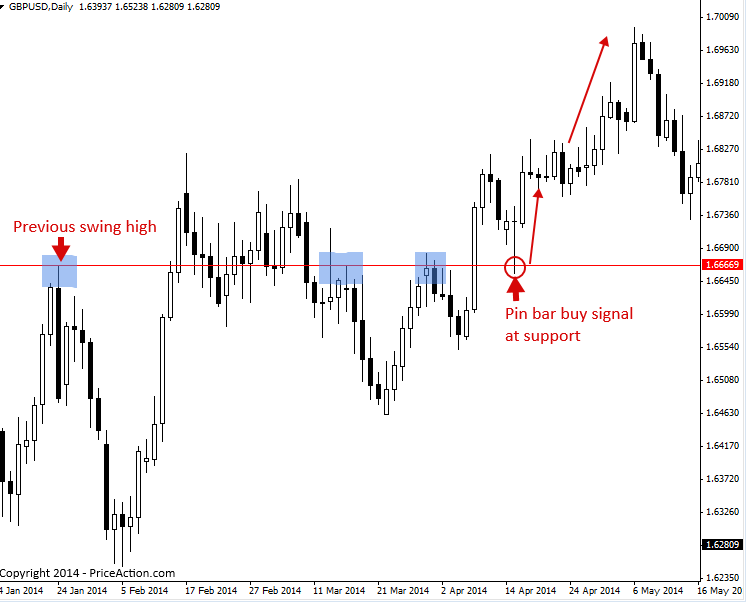

The next chart example show us how sometimes in trending markets a previous swing level will act as a new support or resistance level and provide a good level to focus our attention on for price action entry signals.

In this case, the trend was up and a previous swing high in the uptrend eventually ‘flipped’ into a support level after price broke up above it. We can see that when price came back to retest that level the second time, it formed a nice pin bar entry signal to buy the market and re-enter the uptrend from a confluent level in the market.

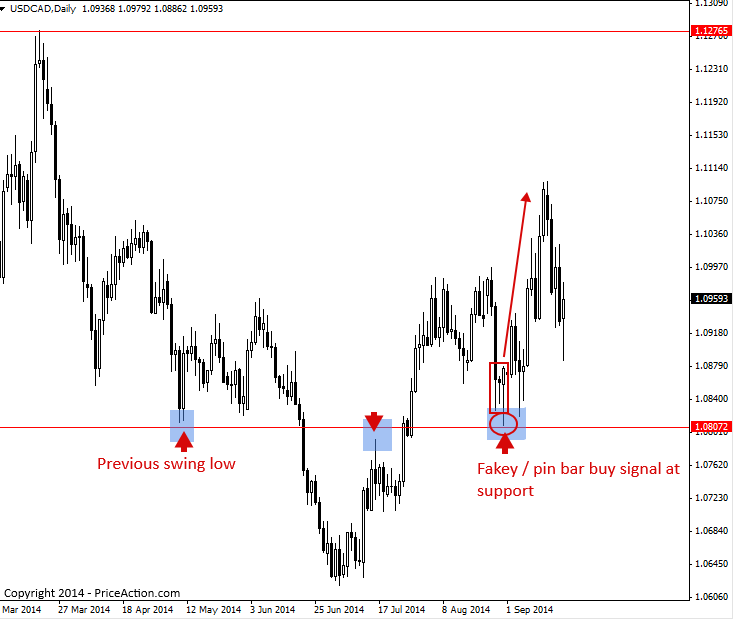

Finally, the last chart we are looking at is an interesting one. Note the swing low that occurred in the down trend on the left side of the chart. You can see how this level stayed relevant months later, even after the trend changed from down to up. It first acted as a resistance level after price broke down through it, but once that resistance was broken, we had an uptrend form and then after that, that same level acted as support, and that’s where we see the fakey pin bar combo signal in the chart below:

Tips on Support and Resistance

- Don’t get too carried away with trying to draw every little level on your charts. Aim to find the key daily chart levels, like we showed in the examples above, as these are the most important ones.

- The horizontal lines of support or resistance that you draw won’t always touch the ‘exact’ high or low of the bars it connects. Sometimes, it’s OK if the line connects bars slightly down from the high or up from the low. The important thing to realize is that this is not an exact science, instead it is both a skill and an art that you’ll improve at through training, experience and time.

- When in doubt about whether to take a particular price action entry signal or not, ask yourself if it’s at a key level of support or resistance. If it’s not at a key level of support or resistance, it might be better to pass on the signal.

- A price trading strategy, such as a pin bar, fakey, or inside bar strategy has a significantly better chance of working out if it forms from a confluent level of support or resistance in a market.

I hope you’ve enjoyed this support and resistance trading tutorial. For more information on trading price action from support and resistance levels, click here.

Price Action Strategies

Support and Resistance Levels Trading Strategy

What is support and resistance? Support and resistance levels are horizontal price levels that typically connect

Pin Bar Trading Strategy

The Pin Bar Pattern (Reversal or Continuation) A pin bar pattern consists of one price bar,

Pin Bar and Inside Bar Combo Trading Strategy

Pin bar and Inside bar Combo Patterns A pin bar is a price action strategy that

Inside Bar Trading Strategy

The Inside Bar Pattern (Break Out or Reversal Pattern) An “inside bar” pattern is a two-bar

False Breakout Trading Strategy

False Breakout Patterns False-breakouts are exactly what they sound like: a breakout that failed to continue

Fakey Trading Strategy (Inside Bar False Break Out)

The Fakey Pattern (Inside Bar False Break Out) The Fakey pattern can be best be described

Nial Fuller

Nial Fuller