One of the biggest reasons you should make price action your one and only trading strategy, is that it will simplify every aspect of your trading, and that’s a good thing. Trading, perhaps more so than any other profession, bombards people with excessive amounts of information, in the form of economic news releases, trading systems and strategies, ‘gurus’, talking heads on financial news networks, etc. It’s important you have some type of filter for all this information, otherwise you’ll experience information overload, which can fry both your mental state and your trading account.

You do not need multiple lagging indicators messing up your charts, despite what many Forex and trading websites would have you believe. All indicators do, is cover up the real story of the market below; the price action.

Trading from the raw price data of the market will work to simplify how you view and think about the market, and of course how you trade it. There’s simply no reason to over-complicate the trading process by adding outside variables like indicators or economic news, these variables only cloud up your thinking and analysis process.

The technical aspect

Let’s take a look at an example of a clean / raw price action chart versus a chart plagued with messy indicators…

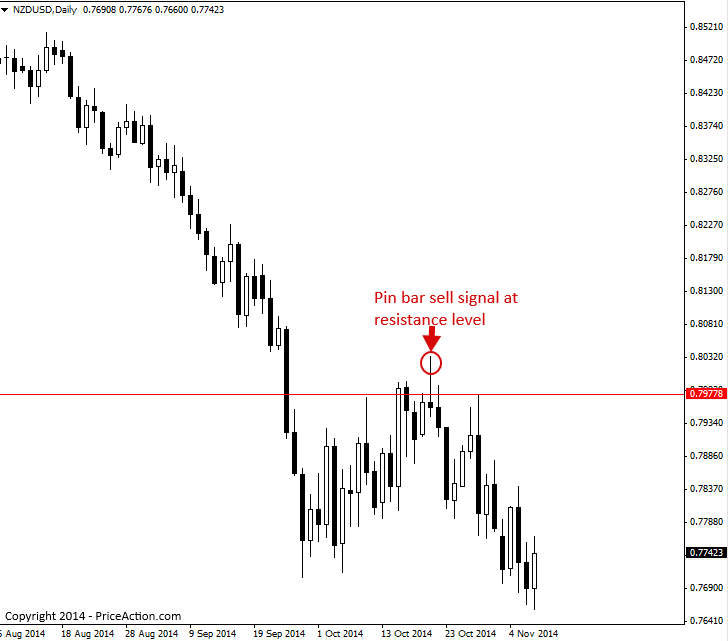

Here’s a clean chart with nothing but price action and a horizontal resistance level drawn in at some bar highs. Note, price was in a downtrend as we can obviously see by the overall decline in prices from left to right, then when price retraced higher temporarily and formed a pin bar signal from resistance, we had a price action signal with confluence. This is an example of how very simple price action analysis can be, nothing messy or confusing about it because we are trading on a clean price action only chart…

Below, we have the same chart as above. Hard to believe, I know. It’s the same exact chart but with some popular indicators added on top of the price action. Not only do these indicators divert your attention away from the price action, which is the only thing that really matters, they also add extra variables that are unnecessary and confusing…

By comparing the two charts above, it should be apparent that you don’t need to use all of those indicators. Note, the pin bar sell signal on the first price action only chart was clearly visible simply by looking at the price action and a resistance level. Had you been analyzing the bottom chart, you may not have taken that pin bar trade because your eyes would have been diverted to the numerous indicators on the charts and you probably would have drawn other conclusions / second-guessed yourself. Indicators are simply a case of ‘too many cooks in the kitchen’, i.e., too many variables making something that is simple by default, significantly more difficult.

The mental aspect

Perhaps an even more important advantage to trading with price action strategies, is that doing so will keep your mental state much ‘cleaner’ and simpler than trading with messy indicator methods or other trading systems. There’s nothing more key to trading success than attaining and maintaining the proper trading mindset. If you don’t do this, you will never make money trading, no matter how good of a market analyst you are.

Trading with price action reduces the market down to its most ‘core’ components and allows you to trade from them. Essentially, you’re cutting out the ‘middle-man’ when you eliminate indicators and start trading ‘in the nude’, i.e. on a price action only chart. This eliminates many unnecessary variables that can cause you to second guess your trading decisions, not be sure if there’s a trade or not, and a whole host of other trading mistakes. Once you’ve learned several effective price action trading patterns, trading really just becomes a game of mental discipline, i.e. waiting for your price action signal to form. Once it forms, you simply set the trade up / pull the trigger, and let the market do the work.

When you’ve simplified your trading with price action strategies, you are much more calm and at ease when you analyze the charts. Having many messy looking indicators strewn about your charts can cause stress and increased blood pressure, and this is a very dangerous mental and physical state to put yourself in when analyzing the markets. Emotion and stress are the enemies of trading success, so the more you can do to reduce / eliminate them the better, and trading with price action is a huge step in the right direction. Remember, price action trading will not only simplify your trading method and your charts, but also your mind and the mental aspect of trading, which is a crucial part of becoming a successful trader.

I hope you’ve enjoyed this short article on why price action strategies will simplify your trading. To learn more visit the Price Action Trading University.

Nial Fuller

Nial Fuller